Starting a nonprofit can be rewarding. It allows you to support a cause you care about.

Before you can begin, you need to understand the legal steps involved. Forming a nonprofit is not just about having a good idea. It involves meeting specific legal requirements. These rules ensure your organization operates legally and effectively. From drafting bylaws to applying for tax-exempt status, each step is crucial.

This guide will help you navigate the legal landscape of starting a nonprofit. Let’s dive into the essential legal requirements you need to know to make your nonprofit a reality.

Choosing A Name

Check if the name is available in your state. The name must be unique. No other nonprofit can have the same name. Use your state’s database to search for the name. This ensures that your chosen name is not already in use. It also prevents legal issues later on.

The name must comply with state laws. Some states have specific rules. For example, some states do not allow certain words. Check your state’s rules before choosing a name. This helps avoid problems when registering your nonprofit.

Credit: store.nolo.com

Board Of Directors

Choose members with different skills. A diverse board is strong. Look for people who care about your cause. They will work harder. Members should have good character. Trust is key. They must also have time to help.

Members must attend meetings. They vote on important issues. Members should read reports. They must know what is going on and make sure it follows laws.

Drafting Bylaws

Bylaws should include the organization’s name and purpose. They must state the membership rules and duties of the board. Define meeting times and voting procedures. Include amendment processes.

Bylaws need board approval. The board must review and vote. Bylaws can be amended later. Keep records of all changes.

Filing Articles Of Incorporation

Each state has its own rules. Check your state’s website for details. Specific forms need to be filled. Some states have online filing options. Others require paper forms. Fees also vary by state. Ensure you pay the right amount.

Start by gathering all needed information. This includes your nonprofit’s name and purpose. You also need to list board members. Have their names and addresses ready. Next, fill out the incorporation form. Double-check for any errors or missing information. Submit the form to the correct state office. Some states offer expedited processing for an extra fee. After filing, keep copies of all documents. These are important for future reference.

Applying For Ein

Applying for an EIN is crucial for forming a nonprofit. This identification number is required for tax purposes and legal compliance. Ensure your nonprofit meets federal requirements by obtaining an EIN.

Purpose Of Ein

An Employer Identification Number (EIN) is like a social security number for your nonprofit. It is used by the IRS to identify your organization for tax purposes. Every nonprofit needs an EIN to open a bank account, hire employees, and apply for grants. It is also important when filing annual tax returns. An EIN helps in maintaining your nonprofit’s financial identity separate from personal finances.

Application Process

To apply for an EIN, you must fill out Form SS-4. This can be done online, by fax, or by mail. The online method is the fastest. It usually takes only a few minutes to complete. By fax, it can take up to four days. By mail, it can take up to four weeks. Ensure that all information is accurate before submitting the form. Any errors can delay the process.

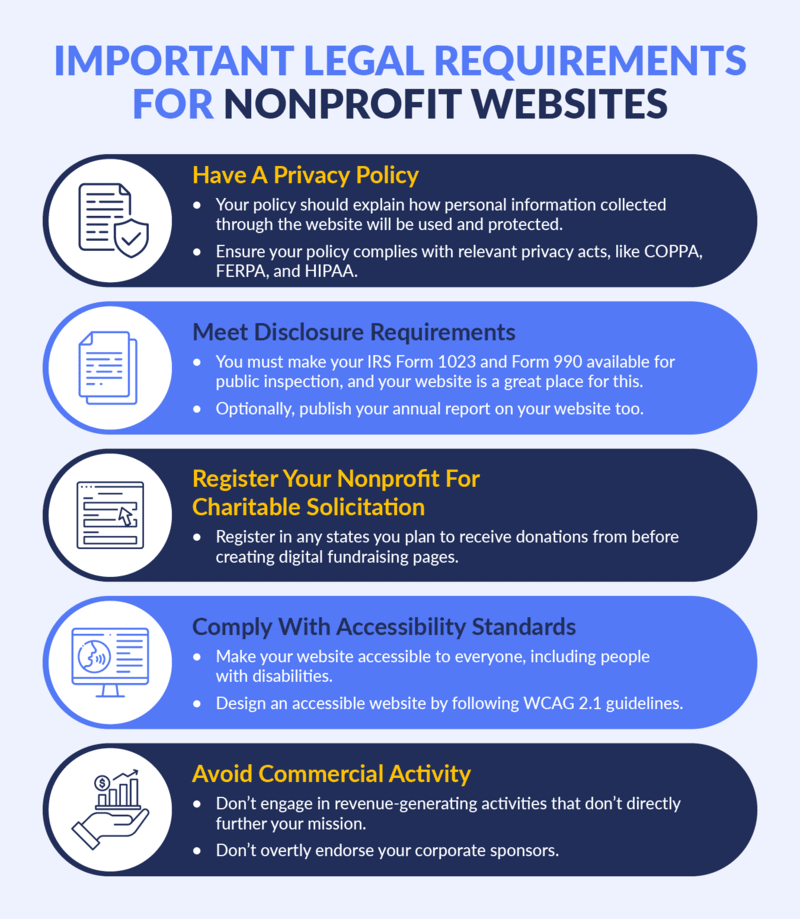

Credit: www.dlgva.com

Applying For Tax-exempt Status

Forming a nonprofit requires meeting specific legal requirements. Obtain tax-exempt status by adhering to government regulations and completing necessary forms. This process ensures your organization can operate legally and receive tax benefits.

Irs Form 1023

Filing IRS Form 1023 is essential to get tax-exempt status. This form helps the IRS understand your nonprofit’s purpose. It also shows how you plan to use donations. The form is long and detailed. Answer all questions carefully. Missing information can delay approval. Include all required documents.

State Tax Exemptions

Each state has its own rules. Check your state’s tax agency website. Some states need a separate form. Others may use the federal approval. Always keep copies of your paperwork. State tax exemptions can save money. Follow the rules to maintain your status.

Compliance With Charitable Solicitation Laws

Before asking for donations, nonprofits must register in each state. This means filling out forms and paying fees. Each state has its own rules. Some states need more details than others. Always check state laws. Failure to register can lead to fines.

Nonprofits must report yearly to the state. Reports often include financial details and activities. This keeps everything transparent. It shows that funds are used correctly. Missing a report can cause issues. The state may revoke your right to solicit funds. Always keep records up-to-date.

Maintaining Nonprofit Status

Keeping accurate records is vital. You must track donations, expenses, and meetings. Store these records safely. They show your nonprofit’s work and spending. Good records help with audits and reports.

Follow all laws to keep your nonprofit status. File annual reports on time. Update any changes in your organization. Stay aware of new laws and rules. This keeps your nonprofit in good standing.

Credit: store.nolo.com

Frequently Asked Questions

What Are The Initial Steps To Form A Nonprofit?

To form a nonprofit, start by conducting a needs assessment. Choose a name, draft a mission statement, and form a board of directors.

How Do I File For Nonprofit Status?

File for nonprofit status by submitting Articles of Incorporation. Apply for federal tax-exempt status with the IRS via Form 1023 or 1023-EZ.

What Documents Are Needed To Incorporate A Nonprofit?

You need the Articles of Incorporation, bylaws, and conflict of interest policy. These documents establish your nonprofit’s structure and operating procedures.

Are There Ongoing Compliance Requirements For Nonprofits?

Yes, nonprofits must file annual reports, maintain detailed records, and comply with state-specific regulations. Regular board meetings are also required.

Conclusion

Starting a nonprofit requires meeting legal requirements. Understand the steps clearly. Register your nonprofit with the state. Obtain federal tax-exempt status. Comply with local regulations. Maintain transparency in operations. Follow these guidelines to succeed. This ensures your nonprofit’s legal standing.

Focus on your mission. Help your community effectively. Stay informed about laws and updates. This keeps your nonprofit on track. Legal compliance is key to achieving your goals. Empower your nonprofit to make a difference.